Imagine standing at a crossroads, staring down two very different paths. One promises quick gains but feels a little risky. The other seems slower, perhaps more demanding upfront, but hints at rock-solid stability and greater rewards down the line. How do you choose? In the world of finance, personal decisions, and business strategy, that's precisely where Cost-Benefit Analysis & Long-Term Savings become your indispensable GPS. It's the disciplined process that lets you weigh every pro and con, turning gut feelings into data-backed decisions that actually build lasting value.

This isn't just for Wall Street titans or corporate boards. Whether you're a small business owner considering a new software system, a homeowner debating solar panels, or simply trying to decide if upgrading your old washing machine is truly worth the splurge, mastering Cost-Benefit Analysis (CBA) is your secret weapon for making wise financial choices and securing those crucial long-term savings.

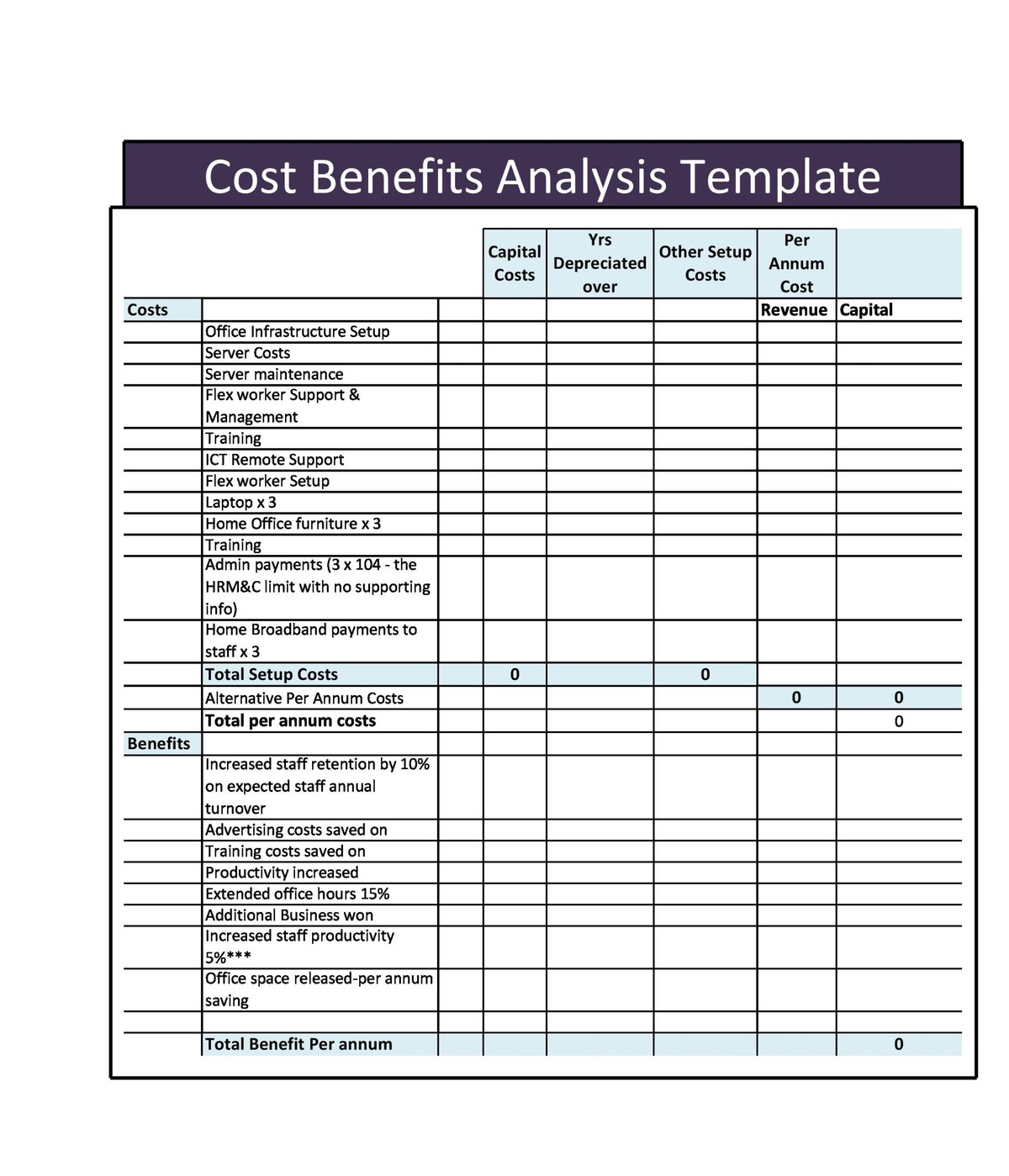

At a Glance: Your Quick Guide to Cost-Benefit Analysis

- What it is: A structured method to evaluate decisions by comparing all the advantages (benefits) and disadvantages (costs).

- The Goal: To help you pick the most advantageous option, ensuring the benefits outweigh the costs over time.

- Why it Matters: Moves you beyond intuition, provides financial clarity, identifies hidden trade-offs, and helps manage risk.

- Key Steps: Build a framework, define your scope, identify every cost and benefit, assign monetary values, compare the numbers, and then make your recommendation.

- Focus on the Future: CBA is especially powerful for understanding long-term impacts, helping you make investments that pay off for years to come.

Beyond Gut Feelings: Why Cost-Benefit Analysis is Your Financial Compass

Let's be honest, we all make decisions based on intuition sometimes. A new gadget looks cool, a business idea feels right, or a quick fix seems appealing. But for choices that truly impact your bottom line and shape your future, intuition can be a risky guide. This is where Cost-Benefit Analysis (CBA) steps in, providing a robust, structured way to assess any project, decision, or investment.

At its heart, CBA is about weighing potential outcomes. You systematically identify every positive (benefit) and negative (cost), converting as many as possible into monetary terms. The primary goal? To see if the benefits of a choice truly justify its costs, especially when considering those vital indirect and long-term impacts. It’s about minimizing risks, optimizing value, and ultimately, making sure your money works smarter, not just harder, to build long-term savings.

For instance, installing energy-efficient windows might seem like a hefty upfront cost. A superficial look might deter you. But a proper CBA would factor in reduced energy bills for decades, increased home value, and improved comfort – tangible benefits that, over time, could far outweigh the initial outlay and lead to significant long-term savings.

The Core Ingredients: What Goes Into a Solid CBA?

Like any good recipe, a strong CBA relies on specific, well-understood components. Think of these as the fundamental pillars holding up your entire analysis:

- Clearly Defined Project Scope: Before you can analyze, you must clearly understand what you're analyzing. What's the specific decision? What are its goals? What outcomes are you expecting?

- Identified Costs: This isn't just about the obvious price tag. You'll dig deep to uncover every financial outflow, both direct and indirect, as well as less tangible sacrifices.

- Listed Benefits: Similarly, you'll brainstorm all the advantages, from easily measurable financial gains to subtle improvements in efficiency or reputation.

- Monetary Valuation: This is where the magic happens. You assign a dollar value to both costs and benefits, allowing for a direct, apples-to-apples comparison.

- Comparison and Evaluation: Finally, you crunch the numbers, using specific metrics to determine if those benefits truly eclipse the costs. This phase also involves considering risks and timing.

Understanding these ingredients is the first step toward transforming your financial decisions from guesswork into strategic moves.

Your Roadmap to Smarter Decisions: The 6 Steps of Cost-Benefit Analysis

Ready to put CBA into practice? Follow this structured, step-by-step guide to conduct a comprehensive analysis that empowers you to make truly informed choices.

Step 1: Laying the Groundwork with a Solid Framework

Before diving into numbers, you need a clear blueprint. This initial step defines the parameters of your analysis:

- Define Your Objective: What specific question are you trying to answer? (e.g., "Should we invest in new office technology?" "Is buying a hybrid car worth it?")

- Set Precise Goals: What are you hoping to achieve? (e.g., increase revenue by 15%, reduce operational costs by 10%, improve employee satisfaction).

- Establish Boundaries: What's included in your analysis, and what's deliberately left out? This might involve defining a specific timeframe (e.g., 5 years, 10 years).

- Identify Stakeholders: Who will be affected by this decision? Their perspectives can help identify hidden costs or benefits.

- Specify Data Sources & Metrics: How will you get reliable information? What financial metrics will you use (e.g., ROI, payback period)?

Step 2: Pinpointing Your Project's Boundaries

Once your framework is ready, narrow down the specific project or decision you're evaluating. This step is about clarity and precision.

- Clearly Identify the Project/Decision: Name it precisely (e.g., "Launching a new organic food line," "Renovating the kitchen").

- Outline Goals & Target Outcomes: What specific, measurable results are you aiming for?

- Detail Necessary Resources: What personnel, equipment, or capital will be needed?

- Set Clear Boundaries for Costs and Benefits: For example, will you only consider direct financial costs, or also potential environmental impacts? A clear scope prevents your analysis from becoming unwieldy.

Step 3: Unearthing All Costs and Benefits (No Stone Unturned)

This is a critical brainstorming phase where you list everything, big or small, that could impact your project positively or negatively. Don't worry about monetary value yet; just get it all down.

The Cost Side of the Ledger:

Think broadly to capture all potential expenses and negative impacts:

- Direct Costs: These are the obvious, easily quantifiable expenses directly tied to the project.

- Examples: Leasing new office space ($5,000/month), purchasing new equipment ($50,000 upfront), hiring and training new staff ($20,000 upfront), raw materials for a new product, advertising expenses.

- Indirect Costs: Expenses not directly tied to the project but necessary for its operation or a consequence of it.

- Examples: Increased utility bills ($1,500/month) for a new facility, higher insurance premiums ($1,000 annually), administrative salaries to manage the project, increased accounting fees.

- Opportunity Costs: This is the value of the next best alternative you give up by choosing this project. It's often overlooked but crucial.

- Example: By investing in a new product line, you might be delaying a menu expansion that could have increased existing sales by 10% (worth $30,000 annually). This missed profit is an opportunity cost.

- Intangible Costs: Harder to measure, these are non-monetary negative impacts that can still have a significant effect.

- Examples: Employee dissatisfaction due to new workflows, negative environmental impacts affecting your brand reputation, increased stress on management, loss of flexibility.

The Benefit Side of the Equation:

Now, shift your focus to all the positive outcomes you anticipate:

- Direct Benefits: Tangible, measurable gains that directly result from the project.

- Examples: Increased sales ($50,000/month or $600,000 annually) from a new product, lower supply chain costs from a new supplier, reduced energy consumption from efficiency upgrades.

- Indirect Benefits: Additional positive impacts that aren't the primary goal but still add value.

- Examples: Improved customer loyalty leading to a 5% sales increase across other locations ($100,000 annually), enhanced brand recognition from a successful marketing campaign, better employee retention due to a new wellness program.

- Intangible Benefits: Non-monetary positive impacts that are difficult to quantify but valuable.

- Examples: Improved employee morale leading to enhanced productivity, increased customer satisfaction, better community relations, strengthened company culture.

- Long-Term Benefits: These are ongoing advantages that accrue over an extended period, crucial for understanding long-term savings.

- Examples: Sustained cost savings year after year, continuous revenue growth, increased market share, a competitive advantage that secures future profitability.

Step 4: Putting a Price Tag on Everything (Monetary Valuation)

This is often the most challenging but crucial step: converting all identified costs and benefits into comparable monetary terms. Some items are straightforward, others require careful estimation.

- Assigning Costs:

- Direct costs are usually easy: equipment ($50,000), rent ($60,000/year).

- Indirect costs like utility increases can be estimated based on historical data.

- Opportunity costs require projecting the lost revenue or profit from the alternative choice (e.g., $30,000 annual profit missed).

- Intangible costs are trickier. You might estimate the cost of reduced productivity due to low morale, or the potential loss of future sales due to damaged reputation. Sometimes, a qualitative assessment (high, medium, low impact) is the best you can do.

- Assigning Benefits:

- Direct benefits are often quantifiable: $600,000 annual revenue increase.

- Indirect benefits like improved brand loyalty might be estimated by projecting future sales increases or customer retention rates (e.g., $100,000 annually from brand loyalty).

- Intangible/long-term benefits often require more sophisticated financial tools like Net Present Value (NPV) to project their future worth in today's dollars. For instance, improved employee morale could translate into reduced turnover costs or higher output, which can be estimated.

Step 5: Crunching the Numbers and Weighing Your Options

With all costs and benefits monetized, it's time to perform the actual analysis. This is where you compare the two sides of your ledger and use various financial metrics to evaluate your options.

- Calculate Net Benefit: The simplest comparison: Subtract total costs from total benefits.

- Example: If total benefits are $600,000 and total costs are $500,000, the net benefit is $100,000. A positive net benefit indicates the project is financially viable.

- Use Key Financial Metrics:

- Net Present Value (NPV): This accounts for the "time value of money," meaning a dollar today is worth more than a dollar tomorrow. NPV discounts future benefits and costs to their present value, giving you a truer picture of a project's profitability over time. A positive NPV indicates a profitable investment.

- Benefit-Cost Ratio (BCR): Divide total benefits by total costs.

- Example: If benefits are $600,000 and costs are $500,000, BCR = 1.2. A BCR greater than 1 suggests the benefits outweigh the costs.

- Payback Period: How long will it take for the cumulative benefits to recover the initial investment?

- Example: An initial investment of $500,000 with annual benefits of $100,000 means a 5-year payback period. Shorter payback periods are generally preferred, especially for projects focused on long-term savings.

- Internal Rate of Return (IRR): The discount rate at which the NPV of all cash flows (both positive and negative) from a project equals zero. A higher IRR generally indicates a more desirable project.

- Consider Time Frames: Costs are often incurred upfront, while benefits accrue over time. Discounting techniques (like those used in NPV) are crucial here to ensure a fair comparison.

- Evaluate Risk and Uncertainty: No project is without risk. Factor in potential unexpected costs (e.g., regulatory changes, supply chain disruptions), lower-than-expected sales (e.g., a 20% reduction during a slow season), or market fluctuations. You might perform sensitivity analysis (see below) to understand this.

- Sensitivity Analysis: This technique examines how changes in key assumptions (e.g., a 10% increase in material costs or a 5% decrease in projected sales) affect the overall outcome of your CBA. It helps you understand the robustness of your decision.

Speaking of smart investments and weighing options, sometimes even the smallest choices can have significant long-term impacts, making you wonder Are rechargeable batteries a good investment? It's all about applying the same rigorous thinking to everything from household purchases to major business undertakings.

Step 6: Making the Call: From Analysis to Action

This is where all your hard work culminates in a clear, data-driven recommendation.

- Formulate Your Recommendation: Based on your findings, should you proceed with the project, cancel it, or revise it?

- Example: If your analysis shows a $100,000 annual net benefit, a positive NPV, and acceptable risks, you'd recommend proceeding.

- Justify Your Decision: Clearly articulate why you're recommending a particular path, referencing the metrics and insights from your CBA.

- Address Long-Term Sustainability and Challenges: Beyond the initial decision, consider the project's ongoing viability and any potential hurdles that might emerge down the road. This foresight is key to securing real long-term savings.

- Outline Next Steps: What actions need to be taken to implement the decision, monitor progress, and manage risks?

Beyond the Spreadsheet: Real-World Applications of CBA

CBA isn't just an academic exercise; it's a versatile tool applicable across a multitude of scenarios, helping individuals and organizations make choices that lead to greater long-term savings and success.

You should consider wielding this financial superpower when:

- Evaluating large investments: Whether it's new manufacturing equipment, a substantial IT system, or a major real estate acquisition, CBA provides clarity.

- Assessing new projects or initiatives: Launching a new product, offering a new service, or starting a community program.

- Analyzing operational changes: Implementing a new workflow, restructuring a department, or changing suppliers.

- Prioritizing competing initiatives: When you have multiple good ideas but limited resources, CBA helps you pick the best one.

- Justifying funding requests: Presenting a clear case for why a particular expenditure is a sound investment.

- Evaluating new business ventures: Before entering a new market or launching a startup.

- Determining environmental or policy decisions: Balancing the financial costs of a policy with its societal and environmental benefits.

- Budget allocation and resource planning: Ensuring resources are directed to areas with the highest potential return.

Real-World CBAs in Action: Mini Case Studies

Let's look at how CBA plays out in common scenarios:

- The New Product Launch (Smartwatch):

- Costs: $200,000 (production, marketing, distribution setup).

- Benefits: Projected sales revenue of $500,000 (first year) - $250,000 (ongoing operational costs) = $250,000 net benefit.

- Recommendation: A strong case for launching, with positive initial returns and potential for growth.

- Building a New Facility (Warehouse):

- Costs: $1 million (land, construction, equipment).

- Benefits: Estimated $150,000 in annual savings (e.g., reduced logistics costs, improved efficiency) over 10 years = $1.5 million total benefit.

- Recommendation: Clear financial advantage over the long term, making the investment worthwhile.

- Upgrading Technology (School District Computers):

- Costs: $50,000 (equipment purchase, training for teachers).

- Benefits: Projecting $100,000 in increased funding over 5 years due to enhanced student performance metrics and improved digital literacy.

- Recommendation: Supports the investment, as the educational and financial benefits significantly outweigh the costs.

- Environmental Policy (City Recycling Program):

- Costs: $200,000 (initial setup, public awareness campaigns, new bins).

- Benefits: Estimated $500,000 in reduced landfill fees and improved environmental health (valued monetarily by health savings) over 10 years.

- Recommendation: A compelling argument for adopting the program, showing substantial returns beyond just financial.

- Employee Training Program (Sales Team):

- Costs: $20,000 (trainer fees, lost productivity during training).

- Benefits: Projected additional revenue of $50,000 annually from a 15% increase in sales productivity over 3 years = $150,000 total benefit.

- Recommendation: This program offers significant returns on investment, leading to enhanced revenue and long-term savings in staffing efficiency.

The Double-Edged Sword: Pros and Cons of Cost-Benefit Analysis

While a powerful tool, CBA isn't without its nuances. Understanding its strengths and weaknesses will help you apply it more effectively.

The Bright Side: Why CBA Shines

- Informed Decision-Making: It shifts discussions from emotional appeals or gut feelings to objective, quantitative data, leading to more rational choices.

- Financial Clarity: By translating diverse impacts into monetary terms, CBA provides a clear, apples-to-apples comparison of costs versus benefits.

- Identifies Trade-offs: It forces you to consider opportunity costs, highlighting what you're giving up by choosing one path over another. This is crucial for maximizing long-term savings.

- Risk Assessment: The process encourages a thorough evaluation of potential risks and uncertainties, helping you prepare for contingencies.

- Structured Approach: It provides a consistent framework for comprehensive evaluation, ensuring no critical factor is overlooked.

The Pitfalls: Where CBA Can Trip You Up

- Complexity of Quantification: Accurately assigning monetary values to intangible benefits (like improved morale) or costs (like environmental impact) can be challenging and subjective.

- Reliance on Assumptions: CBA heavily depends on future projections for costs, benefits, and market conditions. If these assumptions are flawed, the entire analysis can be misleading.

- Potential for Short-Term Focus: Without careful attention, there's a risk that CBA might prioritize immediate financial impacts over crucial long-term savings or strategic benefits that take longer to materialize.

- Subjectivity and Bias: The identification, valuation, and even the interpretation of data can be influenced by personal or organizational biases, skewing the results.

- Data Availability and Accuracy: A robust CBA requires accurate and reliable data, which may not always be readily available or complete.

Your Burning Questions About CBA, Answered

What's the biggest challenge in performing a Cost-Benefit Analysis?

Hands down, the biggest challenge is accurately quantifying intangible costs and benefits. How do you put a dollar value on enhanced brand reputation, reduced stress, or improved community relations? While methods exist (like surveying, or estimating impact on related metrics), they often involve a degree of estimation and subjectivity. The key is to be transparent about your assumptions.

Can I use CBA for personal decisions?

Absolutely! CBA is incredibly versatile. You can use it to decide whether to buy or lease a car, go back to school, renovate your home, or even choose between job offers. For personal finance, it's a powerful tool for understanding the true value and long-term savings potential of any major decision.

How accurate does my CBA need to be?

While precision is always the goal, perfection is often impossible due to future uncertainties and intangible factors. Aim for "accurate enough." The value of CBA often lies not just in the final number, but in the rigorous thinking process it forces you through. Focus on relative comparisons between options and understanding the major drivers of costs and benefits. A good CBA provides a defensible rationale, even if some numbers are estimates.

How often should I do a CBA?

You should perform a CBA whenever you're faced with a significant decision that involves substantial resources or potential long-term impacts. For ongoing projects, it's wise to revisit your CBA periodically or if major variables change, to ensure the project remains viable and on track to deliver its expected benefits.

Moving Forward: Harnessing CBA for Lasting Financial Success

Mastering Cost-Benefit Analysis isn't just about crunching numbers; it's about cultivating a mindset of thoughtful, strategic decision-making. It transforms you from someone who reacts to circumstances into someone who actively shapes their financial future, whether for a business or your personal life.

Start small, perhaps with a minor personal investment or a small work project, to build your comfort and expertise. Practice identifying those hidden costs and benefits, challenging your assumptions, and applying the various metrics. Recognize that a perfect CBA is rare, but a well-considered one is invaluable.

By consistently applying the principles of Cost-Benefit Analysis, you're not just making better choices today; you're laying the groundwork for substantial long-term savings, increased efficiency, reduced risk, and ultimately, a more secure and prosperous future. Take the reins of your financial destiny – one smart decision at a time.